top of page

All Posts

Finding the Right Mortgage for Every Profession

At LJ Mortgage Team , we know that every borrower’s situation is unique. Whether you’re a W-2 employee, self-employed, contractor, or investor , your path to homeownership shouldn’t be one-size-fits-all. That’s why we offer a wide range of mortgage options designed to fit your lifestyle, profession, and financial goals. 💼 Loan Programs We Offer: ✅ FHA Loans – Great for first-time buyers or those with lower credit scores. ✅ Conventional Loans

marketing928870

Aug 27, 20251 min read

✨ Just Closed in Farmingdale! ✨

We’re excited to congratulate our buyers on their brand-new home in Farmingdale, NY! 🏡 This beautiful property features 4 bedrooms, 2 bathrooms, and 1,283 sq. ft. of living space —a perfect fit for their growing family. 📊 The Numbers Behind the Purchase Purchase Price: $609,000 Down Payment (20%): $121,800 Household Income: $123,000 Monthly Debts: $694 Property Taxes: $9,944/year Home Insurance: $2,020/year Monthly Payment (with escrow): $4,197.56 Clo

marketing928870

Aug 26, 20252 min read

✨ Just Closed in Elmont, New York! ✨

We’re thrilled to announce another successful closing in Elmont, NY —welcoming our clients to their brand-new home right in the heart of this vibrant community! 🏡 Elmont is known for its family-friendly neighborhoods, top schools, and unbeatable location just minutes from the Nassau/Queens border. With easy access to Long Island, New York City, and the newly developed UBS Arena area , it’s no wonder more buyers are choosing to plant roots here. The

marketing928870

Aug 22, 20252 min read

💡 What’s an Escrow Account? A Simple Guide for Homebuyers

When buying a home, there are a lot of new terms and processes to understand — and one of the most important is the escrow account . An escrow account is a special savings account managed by your mortgage lender. Each month, a portion of your mortgage payment is set aside into this account to cover important bills like: 🏠 Property Taxes 🔒 Homeowners Insurance This way, when those big annual or semi-annual bills come due, your lender pays t

marketing928870

Aug 19, 20252 min read

💡 What Is Debt-to-Income Ratio (DTI) & Why It Matters for Your Mortgage

When applying for a mortgage, one of the most important numbers lenders review is your Debt-to-Income Ratio (DTI) . Simply put, DTI measures how much of your monthly income goes toward paying debts. The lower your DTI, the stronger your application and the better your chances of securing a great interest rate. Here’s what you should know: ✅ Conventional Loans – Most lenders allow up to 43% DTI (some may stretch to 49% ). ✅ FHA L

marketing928870

Aug 19, 20252 min read

🚨 Closed Loan Spotlight: Bank Statement Loan Win in Nassau County!

At LJ Mortgage Team Inc., we love helping clients find financing solutions that fit their unique situations and this closing was a perfect example. 📍 Location: Nassau County, NY 💰 Purchase Price: $735,000 💵 Down Payment: 25% 📊 Closing Costs: $36,000 📈 Credit Score: 820 📂 Loan Type: Bank Statement Loan Our self-employed client needed flexibility and speed without the hassle of providing tax returns or traditional income documentation. With a Bank Statement Loan

marketing928870

Aug 15, 20252 min read

Understanding Your Loan Estimate – The LJ Mortgage Way 🏡

At LJ Mortgage Team Inc. , we break it all down so you know where you can save. Buying a home is exciting but let’s be honest, the paperwork can be overwhelming. One of the most important documents you’ll see during the mortgage process is your Loan Estimate . This three-page form outlines your estimated interest rate, monthly payment, and total closing costs. But here’s the thing not every number is set in stone . What’s Inside Your Loan Estimate S

marketing928870

Aug 13, 20252 min read

💼 Real Client File Review – See What’s Possible!

At LJ Mortgage Team , we believe in complete transparency and personalized guidance so our clients can make confident homebuying decisions. Here’s a real example of how we help turn dreams into reality: 📍 Purchase Price: $780,000 💰 Down payment: 20% 📈 Credit Score: 780 (Excellent!) 🏡 Household Income: $128,879 💳 Monthly Debt: $0 – strong financial position 📊 Property Taxes: $11,564/year 🛡 Home Insurance: $1,957/year 💵 Closing Costs: $22,000 By reviewing every

marketing928870

Aug 11, 20251 min read

📄 Loan Breakdown – Real Deal in Brooklyn! 🏙️

Buying a home in Brooklyn doesn’t have to feel like an impossible dream and here’s proof! This buyer just locked in an $830,000 property in Kings County with only 5% down . Here’s how the numbers came together : Credit Score: 740 ✅ Income: $213K (Union Worker) 💼 Loan Type: Conforming Conventional 30-Year Fixed Interest Rate: 7.375% Monthly Payment (CD): $6,515.42 Total Monthly Liabilities: $662.19 Property Taxes: $8,142.24 H

marketing928870

Aug 9, 20251 min read

Who Really Controls Your Closing Costs? Let’s Break It Down 💰

When you're buying a home, it’s easy to feel overwhelmed by the long list of closing costs that show up before you get the keys. But did you know not all closing costs are created equal and not all of them are within your control? At LJ Mortgage Team , we believe that understanding the details upfront is the key to a smooth closing. Here's a simple breakdown of who controls what when it comes to closing costs: ✅ Sections A & B – 100% Lender Control

marketing928870

Aug 6, 20252 min read

🔑 One Team. One Mission. One Happy Buyer at 2950 Brighton 1st St, Brooklyn! 🎉

Another closing, another happy homeowner all thanks to the unbeatable teamwork between LJ Realty Team and LJ Mortgage Team Inc. When...

marketing928870

Aug 6, 20252 min read

🎉 Another Happy Homeowner in Yonkers, NY! 🏡🔑

It’s celebration time again at LJ Realty Team! We’re proud to announce the successful closing of another home this time at 37 Lee Ave,...

marketing928870

Aug 6, 20252 min read

🔑 Teamwork That Closes Deals: Another Home Sold in Uniondale, NY! 🏡

Congratulations to our outstanding realtors and mortgage brokers at LJ Realty and LJ Mortgage Team Inc. for making this dream a...

marketing928870

Aug 6, 20252 min read

💰 Breaking Down $22K in Closing Costs on a $700K Home in Nassau County

Buying a home is one of the biggest financial decisions you’ll ever make—so understanding your closing costs is just as important as knowing your monthly payment. Here’s a real-world look at what $22,210 in closing costs looks like on a $697,500 property in Nassau County, with an interest rate of 6.875% and a monthly principal & interest (P&I) of $3,665 . 📊 The Breakdown: Let’s take a look at where your money goes at the closing table

marketing928870

Aug 5, 20252 min read

💡 Should You Buy Down Your Mortgage Rate? Let’s Break It Down.

If you’re shopping for a home loan, you’ve likely heard the term “buying down your rate.” But is it really worth it? Let’s do the math together. Say you lock in a 6.5% interest rate — your monthly principal and interest would be around $3,160 . Now, if you decide to buy down the rate to 6.25% , it’ll cost you roughly $6,200 upfront . Your new monthly payment would be $3,079 , saving you just $81 per month .

marketing928870

Aug 4, 20251 min read

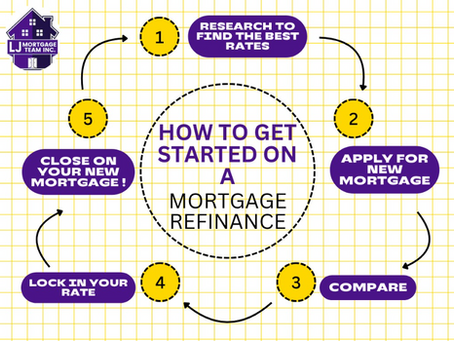

How to Get Started on a Mortgage Refinance: 5 Simple Steps

Thinking about refinancing your mortgage? Whether you're aiming to lower your interest rate, reduce your monthly payment, or tap into...

marketing928870

Jul 29, 20252 min read

Why Income Matters More Than Assets in the Mortgage Process 💼🏡

When it comes to getting approved for a home loan, one thing is crystal clear: your income speaks louder than your assets. Whether...

marketing928870

Jul 25, 20251 min read

📘 Bank Statement Loan – A Game-Changer for the Self-Employed

If you're self-employed and find traditional mortgage requirements hard to meet, you're not alone and more importantly, you're not out...

marketing928870

Jul 24, 20251 min read

💰 Need Cash Without Refinancing? Discover the Power of a HELOC

Are you sitting on home equity but don’t want to disturb your low-interest mortgage? A Home Equity Line of Credit (HELOC) might be your...

marketing928870

Jul 16, 20251 min read

🏡 Self-Employed? Here’s a Smarter Way to Qualify for a Home Loan

By LJ Mortgage Team Are you self-employed and struggling to qualify for a mortgage based on your tax returns? You’re not alone. Many...

marketing928870

Jul 16, 20251 min read

bottom of page